Are you trying to file your taxes, and you’ve stumbled upon a FreeTaxUSA site? So you might be thinking whether this website is legit or offers false claims. We’ll know it in this article.

Since 2001, this online tool has helped millions file without stress—or breaking the bank. Think of it as a friendly neighbor who knows taxes inside out.

Here’s the full scoop on FreeTaxUSA—its story, features, perks, quirks, and why it’s a solid pick for 2025. Plus, answers to common questions to seal the deal.

FreeTaxUSA: Overview

Back in 2001, TaxHawk, Inc., a Utah company, launched FreeTaxUSA. Taxes back then? A nightmare. People wrestled with paper forms or paid solid money for accountants.

FreeTaxUSA said, “Nope, let’s make this easier.” As an IRS-approved e-file provider, it brought tax prep online, keeping things cheap and accessible.

By 2025, FreeTaxUSA will have filed over 50 million returns. That’s a lot of happy filers. Every year, it updates its software to match new tax laws, staying sharp like a well-tuned car.

It’s part of the IRS Free File Alliance, offering free filing for folks earning $79,000 or less.

Back in 2001, only 40% of taxpayers filed online, per IRS data. Now? Over 90% do.

FreeTaxUSA’s low-cost vibe helped fuel that shift, standing tall against pricier options like TurboTax or H&R Block.

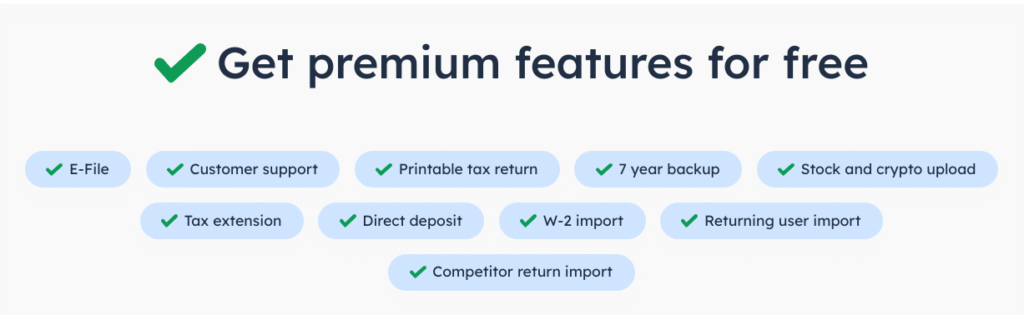

Key Features of FreeTaxUSA

FreeTaxUSA is like a budget-friendly toolbox for taxes. It’s got everything most filers need, without the hefty price tag. Here’s what it offers:

- Free federal filing. Covers almost any tax situation. W-2s, side hustles, investments, rentals—all free.

- Affordable State Filing. Just $14.99 per state. TurboTax charges $39. Big savings there.

- User-Friendly. A step-by-step guide asks easy questions. It’s like following a recipe for your favorite dish.

- Comprehensive Form Support. Supports over 350 credits and deductions. Freelancers, landlords, students—covered.

- Data import. Pulls in last year’s returns from TurboTax, H&R Block, or others. Less typing, more smiling.

- Safe and secure. Top-notch encryption and two-factor authentication. Your info’s locked tight.

- Customer Support. Free email support responds in about 30 minutes. Pay $7.99 for live chat (Deluxe) or $49.99 for Pro Support.

- Guarantees. Get the biggest refund possible, or they’ll refund fees. Errors? They cover penalties.

A friend tried FreeTaxUSA for their freelance gigs last year. Saved $80 compared to TurboTax and filed in under an hour. The good news? These features fit most filers, from first-timers to small business owners.

FreeTaxUSA Benefits

Here’s why FreeTaxUSA is a winner for so many:

- Cost Savings. Free federal filing beats competitors charging $35–$100 for similar stuff.

- Accessibility for Diverse Tax Situations. From W-2s to self-employment, it’s like a multi-tool for tax prep.

- Max refunds. The “Refund Maximizer” digs for every credit. Think extra cash for that weekend getaway.

- Trusted. IRS-approved with an A+ Better Business Bureau rating. Over half of Trustpilot reviews are 5 stars.

- Accessible to all. Free filing for complex returns, not just simple ones. Gig workers and investors love it.

Last tax season, a coworker used FreeTaxUSA for their rental property taxes. They expected a big bill from other services, but paid zero for federal filing. That’s the kind of win that makes tax season less painful.

FreeTaxUSA Drawbacks

No tool’s perfect. FreeTaxUSA has a few limitations you should know:

- No 1099 imports. Got multiple income sources? You’ll type those in manually. A bit tedious.

- Basic design. Functional but not flashy. Think flip phone, not smartphone.

- Paid customer support. The free version has email only. Want live chat? Pay $7.99. Pro help? Up to $49.99.

- Some gaps. No support for foreign income or nonresident aliens. Expats should find another tool.

- No mobile app. Mobile site works fine, but an app would be nice.

Anyway, it still has a better fee structure compared to big names like TurboTax or TaxSlayer. If you’re not longing for high-end features, this platform is all you need.

Who Should Use FreeTaxUSA?

This tool’s a perfect match for:

- Budget lovers. Anyone wanting to keep tax prep costs low.

- Freelancers and gig workers. Free Schedule C filing is a game-saver.

- Complex filers. Homeowners, investors, and landlords all get free federal filing.

- Tech-savvy users. Comfortable with online tools? You’ll breeze through.

Not the best for:

- Filers with foreign income. Foreign income or nonresident alien status? No dice.

- Support seekers. Want free live chat or in-person help? Look elsewhere.

- Mobile app users. Prefer a dedicated mobile app? You’re stuck with the mobile site.

Why FreeTaxUSA Matters

FreeTaxUSA shakes up the tax world. Professional prep costs $220–$323, says the National Society of Accountants. FreeTaxUSA? Free federal, $14.99 state.

That’s huge savings. It’s part of the IRS Free File Alliance, helping folks earning $79,000 or less file for free. In 2024, over 3 million used Free File programs, with FreeTaxUSA leading the pack. It’s like a discount store for taxes—same quality, way less cost.

This tool challenges the big players. TurboTax and H&R Block charge premium prices, especially for complex returns.

FreeTaxUSA says, “Why pay more?” It’s helped millions save money and file with confidence, especially low- and middle-income households.

A Few Tips To Consider

Want to make the most of FreeTaxUSA? Here’s how:

- Gather your docs first. W-2s, 1099s, receipts—have them ready to speed things up.

- Use the import tool. Filed with TurboTax before? Import that return to save time.

- Double-check entries. No 1099 imports mean manual typing. Take it slow to avoid mistakes.

- Try Refund Maximizer. Answer all its questions to snag every credit.

- Start early. Tax season’s hectic. Filing in February beats the April rush.

Last year, a colleague waited until April 14 to start. Big mistake. FreeTaxUSA’s step-by-step guide helped, but they were stressed. Start early, and it’s smooth sailing.

FAQs

Got questions? Here are answers to the most common ones, based on user chatter and research:

Is FreeTaxUSA really free?

Yes, federal filing is free for most tax situations. State returns cost $14.99. No hidden fees, unlike some competitors who sneak in charges for complex returns.

Who can use FreeTaxUSA?

Almost anyone with U.S. taxes—W-2 workers, freelancers, landlords, investors. But not expats with foreign income or nonresident aliens. Those need other tools.

How secure is FreeTaxUSA?

Quite Robust. It uses bank-level encryption and two-factor authentication. Your data’s locked up tighter than a vault. They don’t sell your info, either.

Can I file state taxes with FreeTaxUSA?

Yes, for $14.99 per state. It’s way cheaper than TurboTax ($39) or H&R Block ($37). Plus, it offers state-specific tips to keep things clear.

What if I need help?

Free version includes email support—answers usually come in 30 minutes. Pay $7.99 for live chat or $39.99–$49.99 for pro help via phone or screen share. Audit help costs $19.99.

Does it support self-employed filers?

Absolutely. Free Schedule C filing covers freelancers and small business owners. A buddy used it for their Etsy shop taxes—saved a ton.

Can I import my old returns?

Yes, from TurboTax, H&R Block, TaxAct, or TaxSlayer. W-2 uploads work too, but 1099s need manual entry. A bit annoying, but manageable.

What if I make a mistake?

FreeTaxUSA’s Accuracy Guarantee covers penalties from software errors. They’ll fix it or pay up. Plus, the Deluxe plan ($7.99) offers unlimited amended returns.

Is there a mobile app?

No app, but the mobile site works well. You can file from your phone or tablet. Not as slick as an app, but it gets the job done.

How does it compare to TurboTax?

FreeTaxUSA’s cheaper—free federal vs. TurboTax’s $39–$89. It’s less polished but supports more tax situations for free. TurboTax has better imports and a slicker look.

Can I file if I’m a student?

Undoubtedly. Covers student loan interest deductions and education credits. A cousin filed as a college student and got a bigger refund than expected.

What’s the Refund Maximizer?

It’s a tool that asks extra questions to find missed credits and deductions. Think of it like a treasure hunt for your refund.

Does FreeTaxUSA work for small business owners?

Definitely. Handles Schedule C, rental income, and more. A neighbor’s bakery used it and saved enough for new equipment.

How long does it take to file?

Depends on your taxes. Simple W-2? About 30 minutes. Complex with investments or rentals? Maybe an hour or two. Start early to avoid stress.

Is FreeTaxUSA part of the IRS Free File program?

Yes, for folks earning $79,000 or less. It’s one of the few tools offering free filing for complex returns in that program.

Wrapping It Up

FreeTaxUSA is a gem for anyone wanting to file taxes without spending a fortune. It’s not the flashiest tool, but it’s reliable, secure, and covers tons of tax situations.

From freelancers to first-time filers, it saves time and money. The downsides? A plain interface and some manual data entry.

But for most, the savings outweigh the quirks. Tax season? Give FreeTaxUSA a try. It’s like finding a coupon for something you already love—pure win.